Master Data Quality and Compliance: Why verification matters

High-quality master data is no longer just a matter of operational efficiency, it is a core enabler of compliance, trust, and financial integrity. As new regulations like the EU’s PSD3 bring stricter verification requirements, organizations that invest in clean, validated master data will be better positioned to prevent errors, reduce fraud, and streamline operations.

Poor master data, real-world consequences

Poor quality master data can have direct and costly repercussions. When critical information such as customer addresses, tax numbers, or bank details is incorrect or incomplete, entire business processes begin to fail.

- Operational inefficiencies: Wrong customer addresses lead to misdelivered shipments, delayed invoices, and wasted time fixing mistakes.

- Financial exposure: Incorrect bank details or unverified vendor data can result in payment errors or even fraud.

- Compliance risks: Missing or outdated tax IDs can trigger audit issues and regulatory penalties.

In short, poor data quality creates a ripple effect of errors, rework, and risk across every system and process.

The Regulatory Context: Third Payment Services Directive (PSD3)

A timely example of why data verification matters is the upcoming Third Payment Services Directive (PSD3), proposed by the European Commission in June 2023. PSD3 will replace PSD2 and strengthen consumer protection, Open Banking, and Strong Customer Authentication (SCA).

One of the most impactful changes related to master data is the mandatory verification of the IBAN/Name match, also known as the Verification of Payee (VoP) or Confirmation of Payee (CoP). This pre-payment security check confirms that the recipient’s name matches the bank account number (IBAN) before any payment is executed, preventing misdirected or fraudulent transactions.

Timeline for the new directive:

- October 9, 2025: Payment Service Providers (PSPs) in the Eurozone must provide this service for SEPA transfers.

- 2027–2028: PSD3 and the new Payment Services Regulation (PSR) will expand these obligations to all SEPA transfers.

This regulation reinforces a simple truth: financial processes are only as secure as the data that drives them.

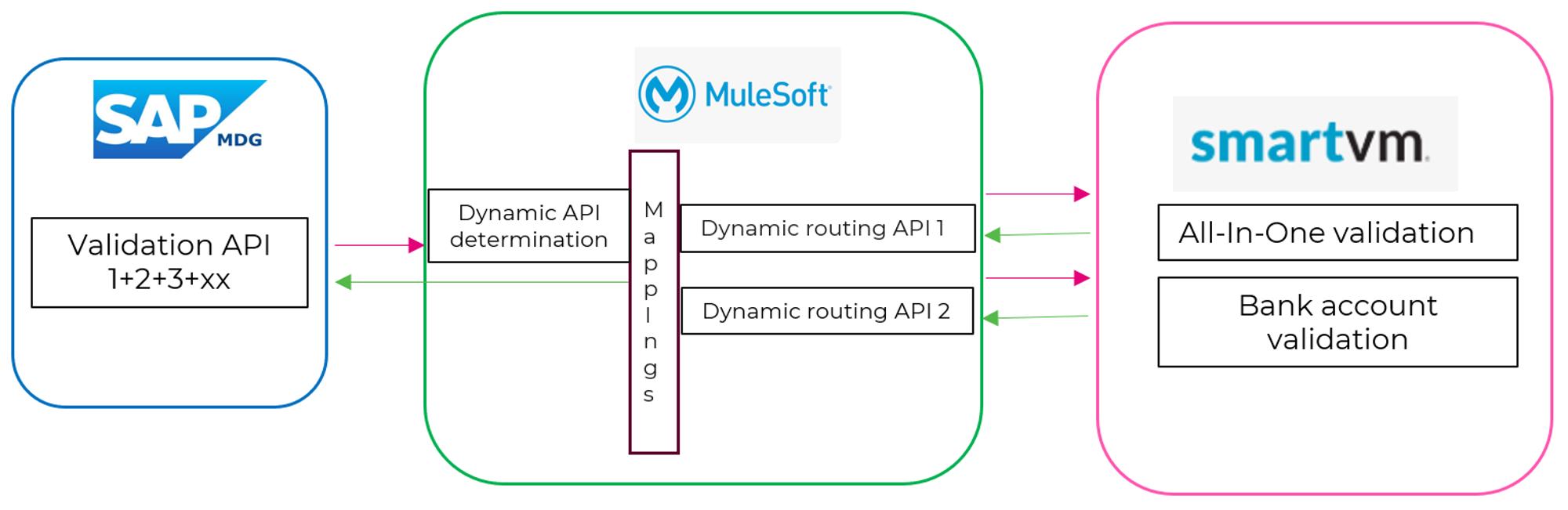

The Solution: Validating master data with SAP MDG, MuleSoft, and SmartVM

Alluvion helped a leading global company for women’s healthcare to safeguard data quality and compliance through a robust validation framework that integrates SAP Master Data Governance (MDG), MuleSoft, and SmartVM by apexanalytix.

SAP MDG

SAP MDG provides a powerful platform for centralizing and governing master data. While MDG includes extensive built-in validation rules, external services are essential to verify information against trusted global sources. Some key external validation use cases include:

Address validation: Ensures global address accuracy down to the street level (E.g.: correcting spelling, adding ZIP/postal codes).

Bank account ownership validation: These services connect to global banking consortia or government databases to confirm that the bank account is legally owned by the Business Partner. This is a primary defense against payment fraud.

Tax ID validation: Checks tax numbers against government databases to ensure fraud prevention, compliance and accuracy.

SmartVM by apexanalytix

SmartVM enhances data validation, cleansing and enrichment for vendor and customer master data by referencing a vast network of government, regulatory, and third-party data sources. Through REST APIs, it helps companies mitigate risk and ensure compliance by performing real-time checks for:

- Tax IDs

- Bank Account ownership

- Address accuracy

- Sanctions and prohibited party lists (e.g., OFAC)

- …

This REST API design allows other business systems, like SAP, to easily call the SmartVM services to perform real-time data validation and enrichment.

The validation in SmartVM follows a composite process that requires a cascading call sequence including:

- A call to the core All-in-One validation API (This API includes addresses, taxes,etc. All included under the same service)

- A call to the dedicated Bank Validation API (premium API) for specific financial checks.

MuleSoft Integration

MuleSoft’s Anypoint Platform acts as the integration backbone, enabling seamless connectivity between SAP and external services. It handles:

- API orchestration and mapping: Transforms data and perform the necessary bidirectional mapping between SAP data structures and SmartVM requirements.

- API Determination: A validation ID must be included within the API call definition to accurately determine and trigger the correct validation process flow.

- Single API contract: A unified API model ensures all validation requests follow a consistent format.

- Response normalization: MuleSoft consolidates results from multiple backend validations into a single, standardized response to MDG.

This layered validation approach ensures that every vendor, customer, or bank record entering SAP MDG is complete, accurate, and compliant from day one.

Conclusion: Turning compliance into a competitive advantage

As regulations like PSD3 tighten the requirements around financial data verification, organizations must view master data quality as a strategic asset. Integrating robust validation mechanisms, such as the presented MDG – MuleSoft – SmartVM framework, help not only to meet compliance mandates but also to build a foundation of trust and efficiency across the enterprise.

Clean, verified master data prevents costly errors, reduces fraud risk, and supports faster, more reliable financial transactions. Mastering your master data is not just good governance, it’s good business.

Maxime Vermersch

SAP Master Data Architect

Maxime is an accomplished SAP Master Data Architect with a wealth of experience in SAP MDG, Integration,...

Let's Make Your Story Next!

Your own success story awaits. Click below to begin your personalized experience.

Let's embark on this journey together!

Connect Now for Your Success Story